Aldi and Lidl were not taken particularly seriously when they started opening stores outside of their traditional German base. In 1999, nine years after opening the first UK store, the Financial Times noted that Aldi had made “little impact in Britain”.

Sainsbury’s and Tesco enjoyed profit margins of approximately 7% during the 1990’s and did not seem bothered about the arrival of the discounter competition.

“We welcome the advent of Aldi and others to come,” said David Malpas, Tesco’s managing director for most of the 1990’s. “We can live quite happily in our part of the market and they can live in theirs”.

But by 2017, Aldi had overtaken the Co-op to become the UK’s fifth largest retailer; today it has a 7.5% market share, closing in on fourth-place Morrisons who has 10.6%. Lidl has 5.3% of the market, more than Waitrose. The two discounters are growing quickly – opening an average of one new store every week.

The former Aldi UK CEO Paul Foley was transparent about the effect of Aldi; “[we are] sucking the profitability out of the industry”.

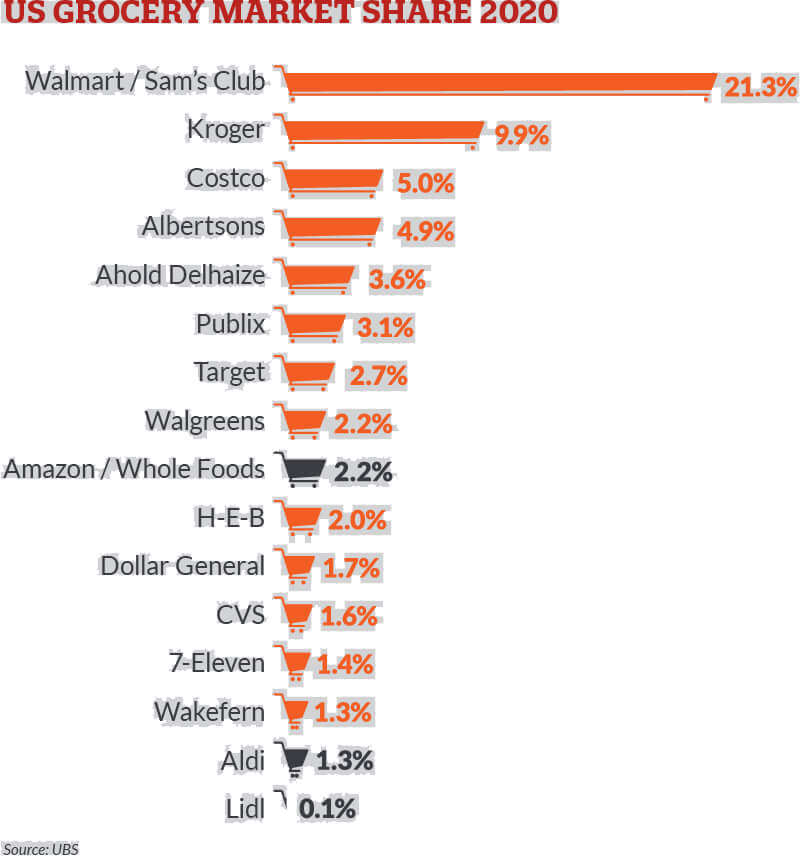

Business Insider notes that individually, Walmart’s US market share, including that of its warehouse chain, Sam’s Club, totalled 21.3% last year. Kroger ranked second with a share of 9.9% and Costco ranked third with a share of 5%. Amazon and Whole Foods, by comparison, accounted for 2.2% of the US grocery market in 2019, which is up from a 1.6% market share in 2017.

Despite the minor market share taken by the discounters to date in the US market, they have already had a profound impact.

John Ross, President and Chief Executive of Independent Grocers Alliance said “our country has been invaded by the German retailers, and they have disrupted the ecosystem quite severely”.

Discounters are taking a bigger share of US grocery bills and pressuring retailers in the US to respond. Grocers in the US are decreasing prices on staples like eggs and milk, and stocking more products that discounters aren’t known for, such as fresh produce.

Within months of purchasing Whole Foods, Amazon offered deliveries to a few American cities within two hours of online purchase. By the end of 2019, that same offer was available across 90 cities – and delivery time was being brought down to an hour.

In January 2018, Amazon launched Amazon Go in the US. Amazon Go allows shoppers to scan their phone on entry, and a series of cameras and sensors ensure the customer is correctly billed as they walk out of the store. As of March 2020, there are 27 Amazon Go stores in the US and there is a launch planned for the UK.

Amazon’s technology driven-strategy is not unique. The tie up between Ocado (a UK online grocery retailer) and Kroger, has provided the US retailer with access to automated warehouses and distribution centres. Walmart is benefitting from an increasingly sophisticated data platform and analytics centre, and this is now being combined with automated grocery picking systems like Alphabot.

Major US retailers have recognised the threat to their margins presented by discounters and the technology behemoth Amazon.

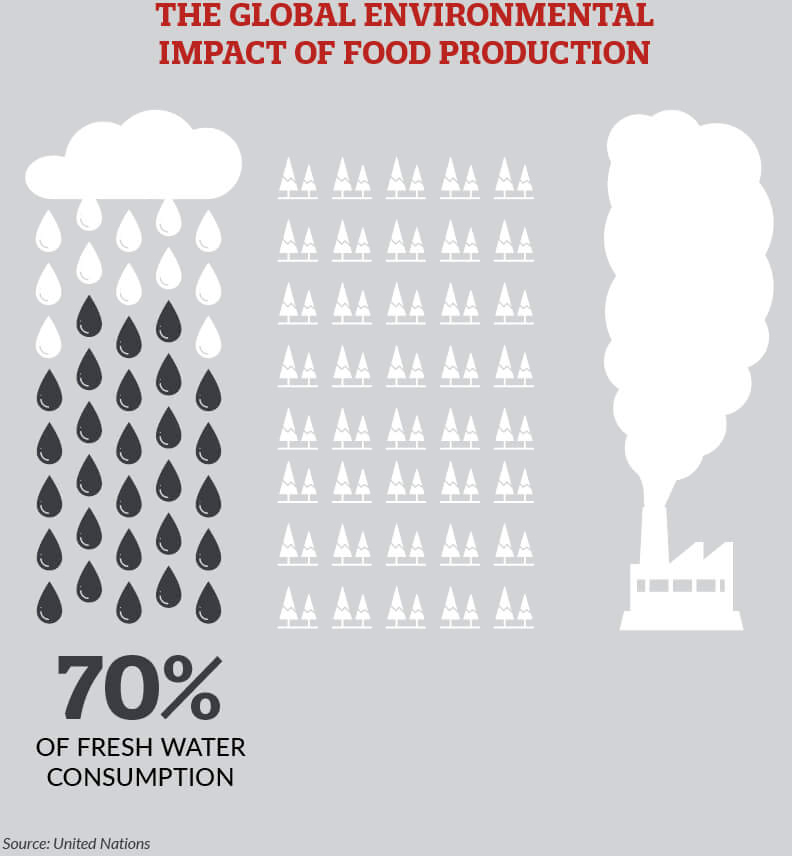

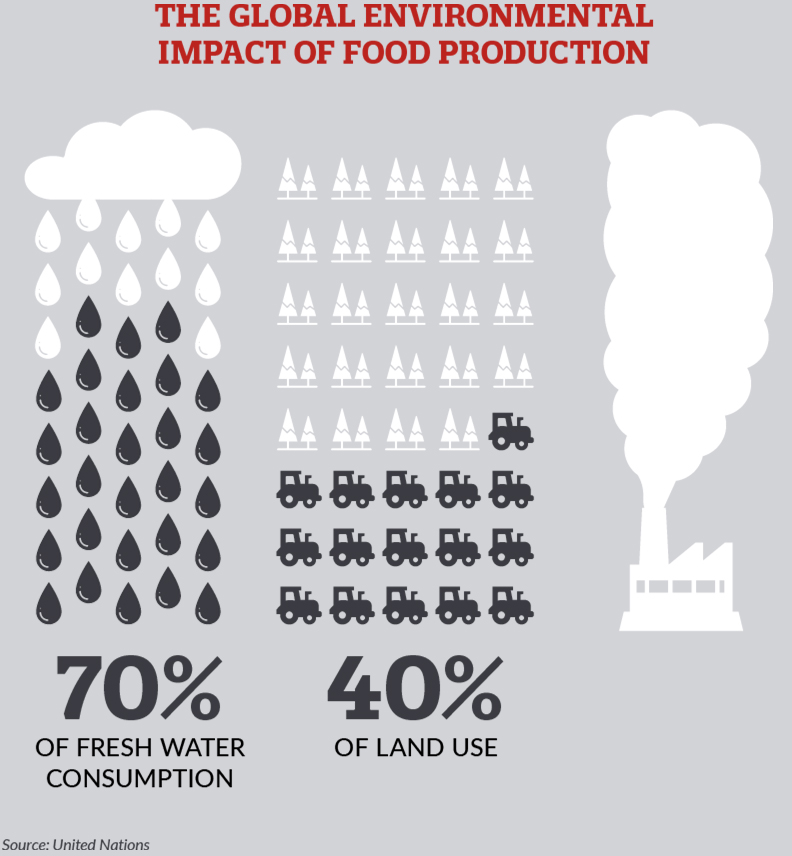

Consumers increasingly care about the total environmental footprint of their purchase. Market trends show a preference toward ‘mindful eating’ – as consumers choose brands and foods that come from sustainable sources.

Millennial consumers are adopting digital solutions that provide instant access to products and services (e.g. Deliveroo and Uber Eats) without being confined to physically nearby choices.

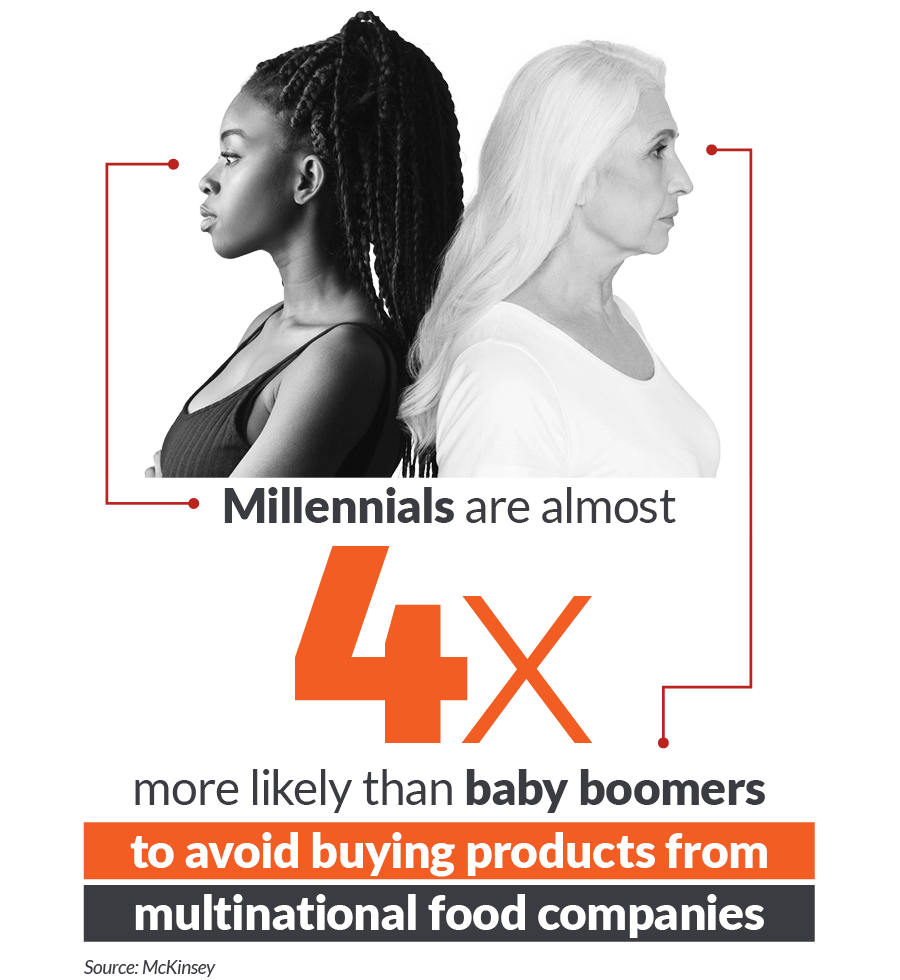

According to recent McKinsey research, the purchasing decisions of those under the age of 35 can make mass brands and traditional channels ill-suited to them. There is a pronounced preference for new brands, especially in food products; the rising popularity of Beyond Meat and Impossible Burger is one example.

The Financial Times reported that the full extent of the COVID-19 crisis on consumer habits and use of digital channels is yet to be fully understood. The need to purchase digitally during the COVID-19 crisis may have a lasting impact on retailers need and ability to reach consumers through online channels.

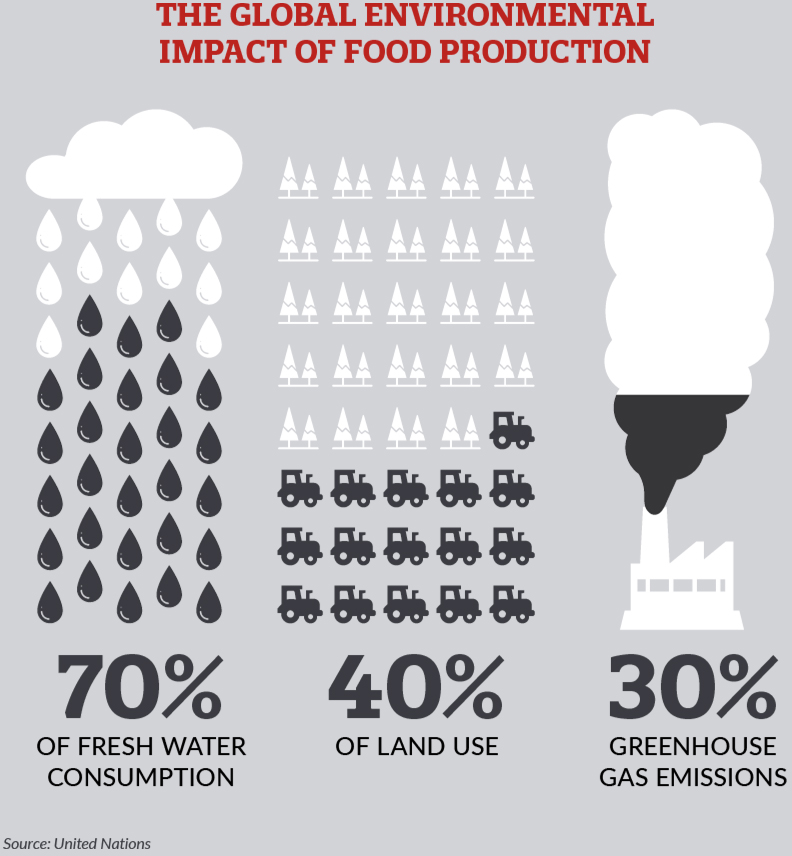

A recent UBS report highlighted some telling statistics around environmental impact of the fresh produce industry.

Farmers will need to produce at least 50% more food by 2050 because populations are growing and incomes are rising.

The changing climate will increasingly impact on food production. The most important agricultural regions worldwide are those most likely to experience difficulties in agricultural output due to drought and excessive heat.

Water use has tripled since the 1950s and demand continues to soar. Demand for water is predicted to exceed supply by 40% in 2030.

The UN’s Food and Agriculture Organization (FAO) estimate that one-quarter of global farmland is highly degraded and another 44% is moderately or slightly degraded.